Flexible terminology- the pace and tenure is actually versatile. One has the new versatility to choose the loan period. They can in addition to select from floating and you may repaired interest levels.

Transparent application techniques- once one is eligible for the fresh homeland features computed new EMI using AXIS Financial Financial EMI Calculator and you will decided on the loan package. They are able to fill out the program. Other techniques could be completed with complete openness.

More gurus- one can like prepayment, additionally the bank will not fees any extra fees. And, they are able to choose import their dated loan so you can Axis bank.

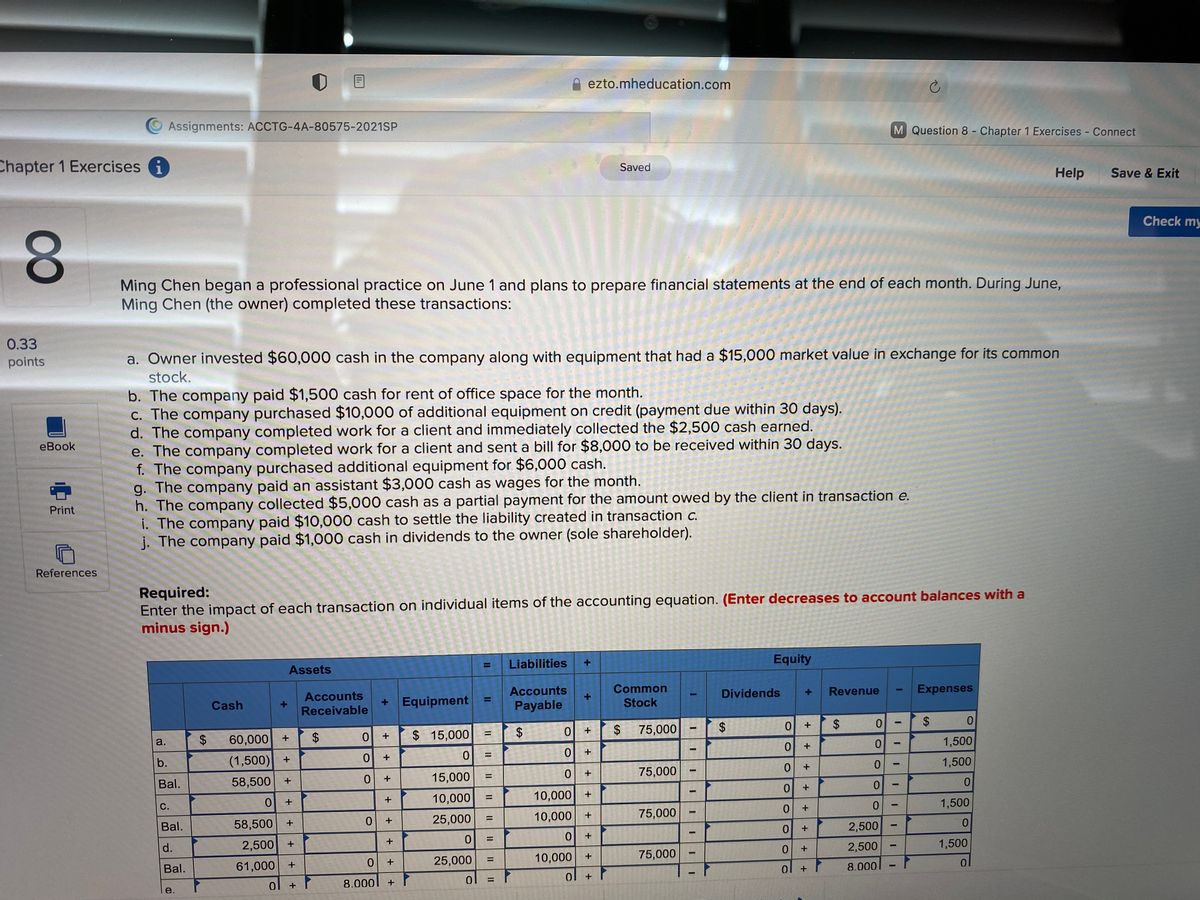

Equated Monthly installments (EMIs) is the lingering matter that the debtor has to spend continuously to clear off of the financing debt. They comprises notice while the principal matter. When you look at the very first many years, the interest is far more, and as the loan will get paid back, the principal part becomes the vast majority of regarding the EMI.

EMI = [P * R * (1 + R) ^ N] / [(step 1 + R) ^ (N 1)] or, utilising the AXIS Financial Financial EMI Calculator .

Really does prepayment replace the Axis Bank Financial EMI?

Prepayment describes paying off the borrowed funds through to the cost plan. It decreases the personal debt plus the appeal fee. AXIS Bank allows prepayment advantage of new a good balance that have nil charges. An educated scenario will be to contain the EMI the same and to lessen brand new period. That way, the loan was paid down prompt. As well as such calculations you can do by using the AXIS Lender Financial EMI Calculator .

What will paydayloanalabama.com/argo/ happen for the a great harmony whether your interest alter?

The EMI would-be inspired on condition that the interest costs is drifting. Therefore, in the event the in the borrowed funds tenure, the latest repo speed grows, then the rate of interest increases, as well as the EMI amount also develops. And can cut in repo price, this new EMI amount will go down. Hence, the latest EMI count calculated using the AXIS Financial Financial EMI Calculator can alter in mortgage period if there is drifting rates.

What is the financing-to-worth ratio to the Axis Bank Home loans?

The expense of the house try put into two-fold (not necessarily equivalent). One region is the loan amount, and almost every other ‘s the very own sum produced by the fresh new debtor. With respect to the property value the house, the mortgage % is set.

What is the EMI matter on Axis Lender Home loan?

The newest EMI hinges on the loan amount, tenure, and you can interest rate. The fresh new AXIS Bank Home loan EMI Calculator allows you in order to determine the EMI. Less than try a table that gives a sense of the way the EMI assortment really works:

Does new EMI count continue to be a comparable on the mortgage period?

Zero, the new EMI number can alter when your interest levels is actually drifting. Having a change in repo speed, the floating rate of interest will change and certainly will affect the EMI amount. To possess repaired interest levels, the fresh new EMI continues to be the exact same unless of course the latest debtor repays the mortgage early or transform the period. All these changes can also be calculated by using the AXIS Financial Mortgage EMI Calculator by simply modifying the speed and you may tenure.

What’s the EMI build for the reasonable loan amount?

A decreased loan amount available with AXIS Lender Mortgage try Rs. step three lakhs. Making use of the rate of interest out of six.9%, the different EMIs according to the AXIS Financial Mortgage EMI Calculator was:

What’s the EMI design toward restriction amount borrowed?

The best AXIS Financial Mortgage is worth Rs. 5 crores. The EMI structure, playing with six.9% since interest, is: