A home loan system originally designed to rejuvenate rural groups might not feel commonly-used, however it sure does have the positives. USDA loans – that are mortgage loans protected by the All of us Agency from Farming – include zero down payment, reduced home loan insurance fees and low interest.

Still, the brand new USDA protected merely 137,000 loans in the 2020. That is right up 38.9% versus 12 months previous, however, USDA money taken into account only 0.4% of the many financial passion last week.

The fresh restricted play with can be a bit stunning given the extensive method of getting these finance. Centered on Sam Sexauer, president out of mortgage financing at Locals Financial within the Columbia, Mo., about 97% out-of U.S. landmass is basically USDA-qualified. Over 100 mil People in the us live-in qualified organizations – of many receive 31 miles otherwise shorter external major metros.

It has been believed that USDA money are only for facilities otherwise agricultural functions, but that’s not true, told you Scott Fletcher, president regarding chance and compliance from the Fairway Separate Home loan, the major creator of USDA mortgages in the united kingdom. USDA loans don’t need to be to possess a farm or features an enormous acreage to be qualified.

Away from it actually. Buyers can frequently have fun with USDA money about suburbs – a place of several has actually flocked since pandemic first started before history year.

That have COVID causing a rush towards suburbs, USDA fund was a funding getting financing property, said Wayne Lacy, part manager and older mortgage maker on Cherry Creek Home loan during the DeWitt, The state of michigan. They supply a minimal mix of private home loan insurance and you may down payment of all loan choices, and create to invest in very affordable.

What are USDA money?

USDA fund – typically referred to as outlying homes funds – is actually covered by U.S. bodies, alot more particularly the fresh new USDA. New funds was indeed established in 1991 to grow and you can offer a great deal more outlying groups, however, a large swath of the nation is simply eligible.

This new USDA’s concept of rural’ is a lot broader than many do guess, said Ed Barry, President away from Resource Lender inside Rockville, Md. Homebuyers will dive for the achievement that areas or details these include offered commonly rural’ on the conventional sense, so they don’t even see a beneficial USDA financing might be an enthusiastic alternative.

People can be examine regional USDA availability by visiting the brand new department’s property qualifications device, plugging inside the a speech, and you will watching brand new USDA boundaries into the map. Generally speaking, areas shady orange cannot qualify. These types of typically is large cities in addition to their denser, so much more instantaneous suburbs.

An illustration ‘s the Houston town. Regardless of if Houston proper isn’t qualified to receive USDA financing, of numerous communities only 29 kilometers aside was. This includes places like Cleveland, Crosby and also components of Katy – the top area to own inwards movements in pandemic, considering an analysis regarding USPS alter-of-address studies.

As to why explore a USDA financing?

If you find yourself to buy from inside the a great USDA-qualified town, these types of lower-pricing funds can be worth planning. For example, they won’t want a down payment – and certainly will mean larger discounts straight away.

The greatest perk of USDA mortgage is the fact discover zero dependence on a deposit, Sexauer told you. Outside of the Virtual assistant loan, USDA investment is the simply 100% investment option available. (Va fund are arranged only for effective military participants, pros and their partners, making them unavailable to your almost all homebuyers. However, the new Department of Pros Situations protected accurate documentation step one.2 million lenders just last year.)

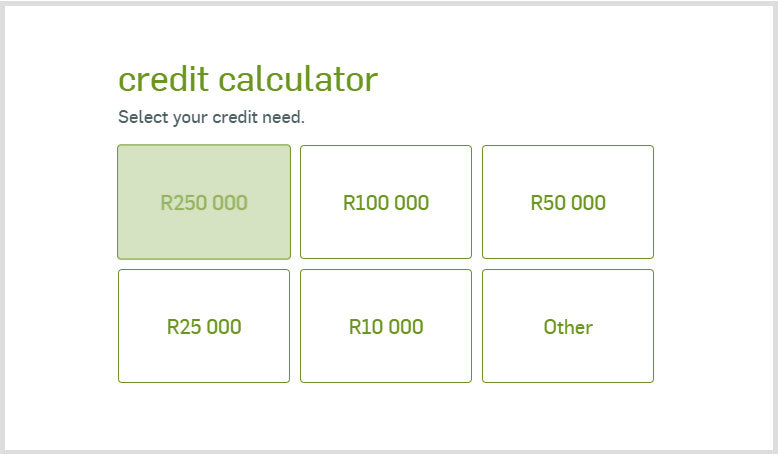

Locate a sense of exactly what a good USDA financing helps you to save your, thought old-fashioned loans Tidmore Bend finance – the most common sorts of financial in the business. At minimum, antique fund need at least an excellent step 3% down payment, otherwise $fifteen,000 with the $250,000 household. FHA financing want significantly more – anywhere from 3.5% in order to 10% dependent on your credit score.