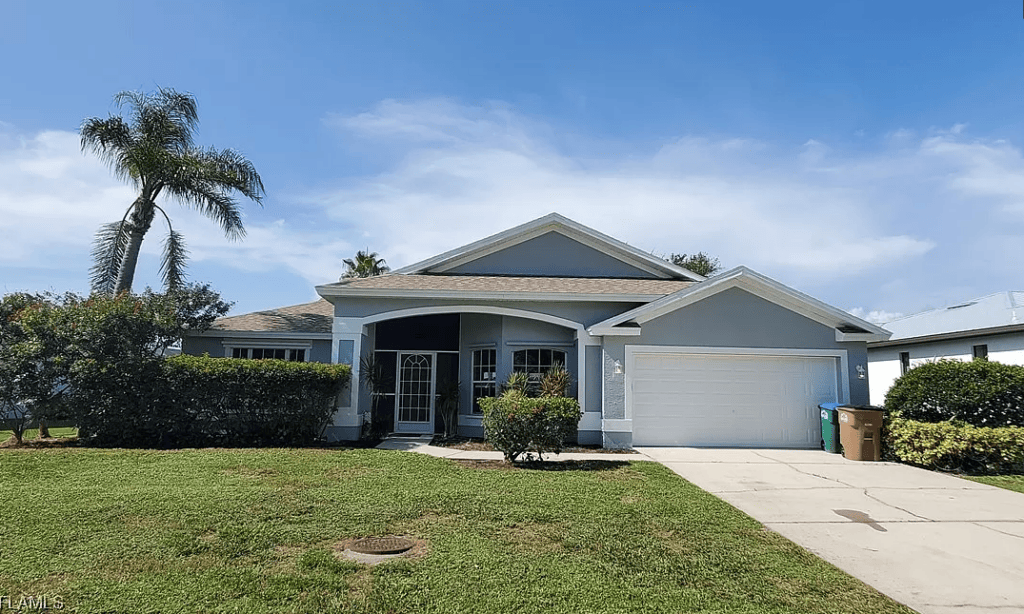

Alternative 3: Transfer to our home

If your residence is in your relatives and you’ve got happy memories of they, or you’re currently renting and ready to be a homeowner, it might be a zero-brainer to visit which route.

And if you are inheriting a home which is paid off, you won’t need to worry about and come up with any additional monthly premiums, and that’s a comfort – specifically if you arrived to the brand new heredity suddenly.

Remaining the house you’ll imply you’re entitled to a capital gains difference of up to $250,000 out of your income as an individual filer otherwise around $five-hundred,000 if you document a mutual come back with your spouse, so long as you satisfy a couple conditions:

- Our home is employed as your first quarters for around several from five years.

- In the a couple of years preceding the sale of the home, you have not used the capital progress difference to the yet another possessions.

Yet not, when there is however a great mortgage equilibrium with the family, you will need to focus on particular wide variety to decide when it tends to make feel to take on that financial load. In many cases, as previously mentioned significantly more than, the balance towards mortgage can get surpass the latest residence’s worth, the expenses out-of repairs and you can taxation is unaffordable to you personally, otherwise prominent and focus (P&I) you will simply be a lot to handle. Whilst it may seem like the easiest choice, we want to guarantee that you aren’t getting in more your own head prior to taking ownership of the home.

Let’s review; If you’ve has just handed down property, here are the very first one thing you ought to see off of your own checklist:

If you’re not the only real Heir….

There are facts where you may possibly not be the latest sole heir so you can inherit the house, and is also in fact fairly preferred to possess family members which have several pupils to obtain the sisters as one inherit the home. At times, it could be simple enough to come calmly to a common agreement into whether or not to offer or rent the home, but different characters and different priorities can conflict with regards to so you’re able to deciding an educated path to take.

You’ve probably the choice to buy from most other heirs if you are paying all of them bucks due to their express and achieving all of them https://paydayloancolorado.net/stonewall-gap/ indication brand new deed over to you, but it is important to keep in mind that this could suggest more substantial homeloan payment on exactly how to deal with as a result. you may prefer to spend closing costs into household and additionally an appraisal to determine the home’s value.

If you have has just passed on a property or expect you’ll in the upcoming, contemplate using the fresh guarantee you have accumulated on your own first possessions to get bucks getting repairs otherwise home improvements, or even to let manage a fantastic costs on house.

Tap into the guarantee and no monthly payments. See if your prequalify for an effective Hometap financial support in less than half a minute.

You need to know

We carry out the best to make sure that the information inside this article is due to the fact direct as you are able to at the time of the fresh day it is penned, however, things change quickly possibly. Hometap will not promote or display screen people linked websites. Individual facts disagree, very consult with your own money, income tax or lawyer to see which is practical for you.

2022 Property Taxation from the County

For individuals who go that it channel, there’s also the chance that our home may need home improvements prior to it is possible to rent it out – thus, just like when you find yourself creating enhancements ahead of selling, it could be beneficial to browse resource choices to discover better complement your financial situation.