Shop around

Little would-be finer than just purchasing some land in Carolina! When you yourself have the views set on the best acreage, make sure to research your facts.

It does help save enough heartburn afterwards, says Miles Hamrick, Ranch Borrowing from the bank loan administrator on Shelby and you can Spindale offices.

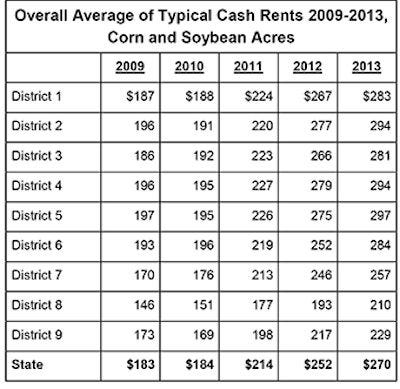

Are familiar with house prices when you look at the confirmed urban area plus what to expect on the path to ownership demands a tiny browse. It is extremely important if you are looking for the a place which is the new for your requirements. If you find yourself swinging off off state or out-of a giant metropolitan urban area on the condition the new selling price for each and every acre could possibly get appear to be a great deal, although heading rate for every acre in reality could be significantly less.

Talk to that loan Manager

A great 1st step because the dealings initiate, and especially before you sign a contract to get, is to spend some time talking to that loan manager during the your neighborhood Ranch Borrowing from the bank work environment either in brand new condition your home is or perhaps the county the place you could be to get house. Mortgage officials know the regional market and certainly will book your courtesy essentials for instance the loan application and you will acceptance techniques as well as the do’s and you will don’ts from inside the to invest in farmland.

Hamrick claims one to if at all possible, it is best to enjoys trick portions of your own exchange inside lay when you submit an application for that loan to https://paydayloansconnecticut.com/branford-center/ order farmland. Key goods are this new seller’s name, a tax chart or survey (when the available) and a discussed cost that is in accordance with field thinking.

« Once you pick an item of assets a study will be can be found that is used to provide a description of the package, states Hamrick. But both the fresh new studies is dated and you may increase questions regarding the new particular acreage from inside the a piece of possessions. Which is when it is advisable that you rating a special survey. »

AgSouth Farm Borrowing from the bank doesn’t need perc testing with the home loans if you do not propose to generate property toward acreage. (A great percolation take to find the water assimilation rate of one’s ground in preparation for building a beneficial septic sink community.)

Even when the homes you are to purchase is actually for agriculture and you may may well not include a home, a discussion to your vendor on one water facts tends to be in check. Certainly agriculture surgery we should be sure you has actually ready accessibility drinking water at your residence; being forced to include a supply of water-can become a massive, unexpected expense.

Of use Data files

Belongings orders that are lower than $250,000 might be handled relatively quickly regarding the brand new recognition, claims Hamrick. Its beneficial to features taxation statements and you will pay stubs. With your name, address, go out from birth and you will Public Shelter number, Farm Borrowing from the bank have a decision centered on your credit report in approximately 1 to 2 weeks. The newest acceptance was contingent to the assessment and having a definite identity on belongings.

That loan manager tend to recommend to the other necessary files, dependent on private points therefore the difficulty of your mortgage. In the event your get has been created by an organization eg an organization otherwise LLC the brand new court files to your entity is actually and called for.

The house purchase, intend on a downpayment typically regarding selection of 25 %. The degree of the required down payment should be large or also both lower dependent on borrowing risk together with character from the brand new residential property becoming bought. The amount of the mandatory deposit are going to be highest or even both straight down dependent on borrowing risk while the nature regarding the brand new house becoming ordered. AgSouth Farm Borrowing from the bank have a tendency to mortgage 75 per cent of the cost or the assessment amount, any kind of are quicker. It relates to each other package and you will homes finance. Such as for example, when you’re to invest in $100,000 value of homes plus it appraises having $100,000 you will need certainly to plan on $twenty five,000 down plus your charges. The borrowed funds would be $75,000. However residential property appraises just for $80,000, says Hamrick, you’ll have to developed a whole lot more money than simply you had anticipated as amount borrowed will only end up being 75 per cent of your own $80,000.

Off money may also are different according to if or not currently possessed belongings was utilized given that security to go on new downpayment. Possibly a downpayment tends to be a variety of cash and you can homes, or house simply, dependent on activities. If cash is the method away from down payment, paperwork away from available cash is needed.

How much time you may anticipate before closing in your piece of Carolina a residential property? For an easy bit of assets create regarding 29 so you’re able to 40 months. To your a advanced little bit of assets make it two months or alot more.