When you look at the 2012, Wells Fargo reached an excellent $175 billion payment with the Fairness Service to pay Black and you will Latinx consumers just who qualified for financing and you can had been billed higher costs or pricing or poorly steered on subprime finance. Other financial institutions including paid back settlements. However the injury to families of colour was lasting. Property owners besides missing their houses however the opportunity to recover the money whenever homes rates plus mounted back up, adding once again into the racial wealth gap.

Inside , the latest Government Set aside showed that the common Black and you may Latina otherwise Latino house secure about 50 % around the typical Light domestic and you may very own just about fifteen% to 20% as much web wealth.

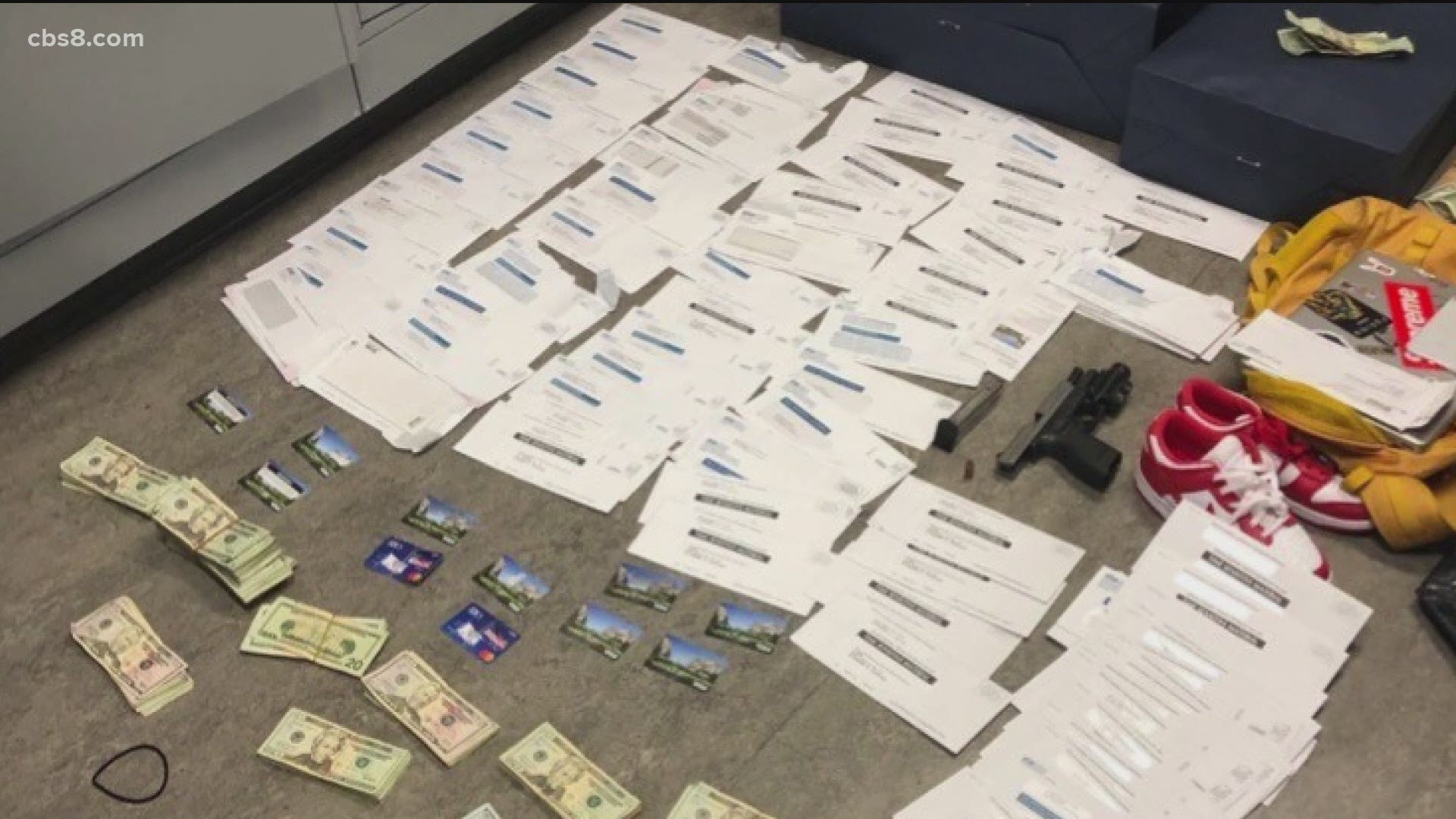

Payday loans

The brand new payday loans globe lends vast amounts of dollars a year within the short-dollar, high-prices fund since a link to another location pay-day. This type of money generally try for two weeks, that have annual fee pricing (APR) between 390% to 780%. Payday lenders work online and due to storefronts largely inside the financially underserved-and you may disproportionately Black and you may Latinx-communities.

Although the government Information inside the Lending Work (TILA) means pay day lenders to reveal the financing charge, a lot of people disregard the costs. Very funds is to own 30 days or less which help borrowers to generally meet small-name liabilities. Loan number within these fund are usually out of $100 so you can $1,000, having $five-hundred getting common. The brand new finance can usually end up being folded more than for additional funds charges, and many individuals-as high as 80% of them-become repeat people.

Which have the brand new costs extra anytime an instant payday loan is refinanced, your debt can easily spiral out of control. Good 2019 study discovered that having fun with pay day loan increases the speed from bankruptcy proceeding. A lot of judge cases was submitted up against payday loan providers, once the lending laws were passed while the 2008 financial crisis in order to make a clear and reasonable lending marketplace for consumers. not, look suggests that the brand new and that it liked a boom throughout the brand new 20202022 COVID-19 pandemic.

In the event that a lender attempts to rush your from recognition procedure, does not answer your questions, otherwise indicates you acquire more income than you really can afford, you need to be wary.

Auto-Label Financing

These are single-fee money centered on a portion of your car’s really worth. They bring high-rates of interest and you may a necessity at hand along side automobile’s title and you may an extra selection of tactics since guarantee. With the about one in five borrowers that have its vehicle grabbed because they’re not able to repay the loan, it is not just a financial loss but may and jeopardize availability in order to jobs and you will childcare to have a family group.

The newest Different Predatory Credit

The strategies are showing up in the therefore-titled concert economy. As an example, Uber, this new trip-revealing service, agreed to an effective $20 mil payment into Federal Trade Payment (FTC) in 2017, partly to own automotive loans which have dubious borrowing from the bank terms your system expanded to help you the vehicle operators.

Someplace else, of many fintech providers was introducing things entitled “pick now, spend after.” These materials are not constantly clear on charges and you may rates of interest and can even entice users to fall to your a debt spiral they will not be able to escape.

To safeguard people, of many states have anti-predatory financing guidelines. Specific says keeps outlawed pay check financing entirely, while others provides lay hats into the amount loan providers can charge.

The fresh You.S. Company regarding Property and you may Metropolitan Development (HUD) additionally the Consumer Monetary Shelter Bureau (CFPB) have taken procedures to battle predatory financing. But not, since moving forward posture of your own second service reveals, laws and you can protections try subject to alter.

Inside the , the fresh new CFPB awarded a last code establishing stricter laws toward underwriting of pay day and you will automobile-name funds. Up coming, significantly less than this new leaders into the , the CFPB revoked one to rule and you can delayed other tips, most decline federal user defenses facing such predatory loan payday loans online Maryland providers.