Obtaining home financing was a rigid procedure that involves several procedures. Many people do to overcome a few of the fret in the applying for a home loan is to obtain pre-acknowledged. Getting pre-approved to own home financing ensures that a lender have a tendency to review their information to choose if you would feel acknowledged or otherwise not. Pre-approvals dont make certain that you’re acknowledged getting an effective home loan.

What Pre-approvals manage when looking for a mortgage

bad credit personal loans in North Carolina

Pre-approvals be more out of a preventive level to evaluate what property you need to be looking at. Extremely manufacturers are more prepared to discuss prices which have pre-accepted anybody. This is simply one of the many benefits of taking pre-acknowledged.

While you are wanting taking pre-acknowledged to have home financing, discover certain important info you have to know. Lower than, we are going to provide you with all the information from the as to why you should know providing pre-recognized getting home financing.

Exactly how providing pre-accepted getting home financing works

Before getting pre-acknowledged to have home financing, you will find several things want to do. Very first, it is best to feedback your credit score and you may obligations-to-earnings ratio. This will make you an exact check out just how much domestic you can manage.

Of several lenders want to see a minimum FICO rating out-of 620 just before also provided approving the application. The lower the score try, the greater down-payment are expected initial at the time off closure. Borrowing from the bank is just one of the critical situations one influence your own pre-acceptance chances.

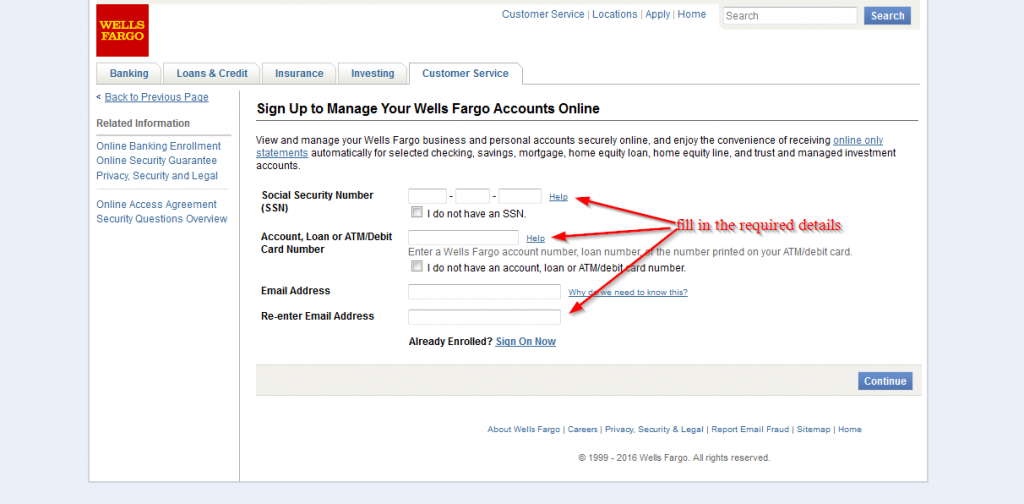

? Proof of Work- before any lenders approve you, they’ll need to see evidence of your own work. You can utilize W-2 or spend stubs comments to prove your revenue. The more your revenue suits their wanted loan amount, the greater their recognition chances are. ? Proof Assets- you ought to be sure your own assets before any home loan company often elevates surely. You’ll want to bring records of one’s funds and money account. ? Evidence of Money- lenders may wish to see your prior year’s tax returns and you can any data that can confirm your income source. That it contributes more safeguards for lenders against individuals which default. ? General Records- you’ll need to give information that is personal in regards to you, such as your societal cover amount and you will driver’s license within closing.

Advantages of bringing pre-accepted to have a mortgage

The primary advantage of bringing pre-accepted to possess a home loan is you provides lay borders. Mortgage pre-approvals qualify your to have a specific amount borrowed; without one, you could invest a lot of time into funds which you never ever qualify for in the first place.

Some body And Inquire

Q: How long does it attempt get pre-acknowledged for a mortgage? A: an average of, it only takes 1-three days total to get a decision in your financial pre-approval application. The process can take extended, depending on people conditions that develop through the handling.

Q: How to proceed before getting pre-acknowledged for a home loan? A: Before you apply to own mortgage pre-approval, you should go after a few methods. Earliest, rating a free of charge credit rating and comment your debts. 2nd, plan out all your private and you may monetary advice. In the end, fill out your own home loan pre-recognition app.

Q: Can that loan getting rejected just after pre-recognition? A: yes, even with getting pre-acknowledged, you could potentially remain refused a mortgage. The latest pre-approval procedure is merely a good pre-emptive size for you to decide how far family you might pay for.

Finding out how taking pre-acknowledged to have a mortgage performs

To really make the means of buying your next domestic simple and you can quick, get pre-recognized. Have fun with the information in this post to help go through the entire processes. Very, you could begin surviving in your new household today! Hoping to get recognized for a loan? Get in touch with Priority Financing right now to start off.